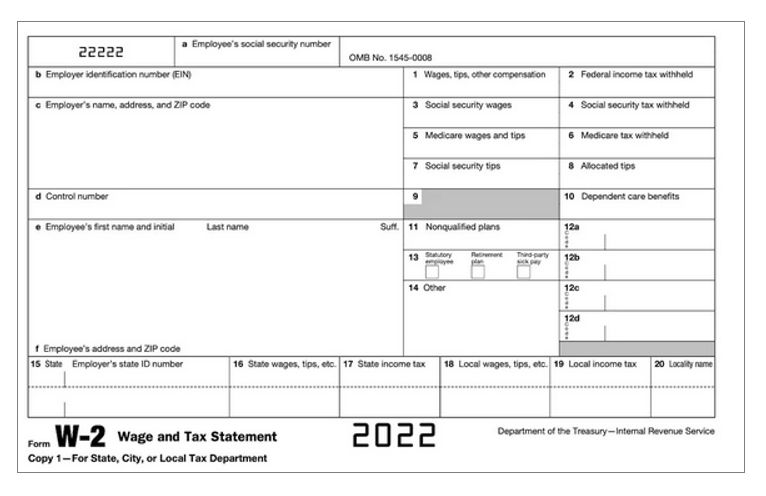

Don’t Throw Your W-2s Away!

By February, millions of Americans will have received their W-2s showing the income that was paid to them by their employer(s) last year. Even if you’re not required to file a 2022 tax return, it’s important that you hold on to your W-2s, because you may need them for your Free Application for Federal Student Aid (FAFSA) next year.

Now, let’s talk about 2021. On your FAFSA, you’ll always be asked to submit income information from two years prior to the year that you’ll be attending college. That means if you’re submitting the 2023-2024 FAFSA—the application high school seniors should be submitting now—you’ll need your 2021 income information. You may not have been required to file a tax return that year, but any income you earned in 2021 still needs to be reported on your FAFSA. If you didn’t file a return in 2021, it’s even more important to keep those W-2’s in a safe place for reference.

If you’re a dependent student,* your parents will also need to report their income. Even if they have a copy of their tax return with them, parents should also have their W-2’s handy because the FAFSA is likely to ask questions that they can only find answers for on the W-2s.

Since you must complete the FAFSA each year that you need federal and state student aid, it’s best to keep all relevant documentation together in a safe location, including your FSA ID (username and password). This will help you complete all future FAFSAs more quickly and accurately.

Always provide your income information from the tax year two years prior to the year that you’ll be attending college.

| For FAFSA year… | Use income information from… |

| 2023-24 | 2021 |

| 2024-25 | 2022 |

To learn more about who was required to file a 2021 tax return, see the 2021 IRS Form 1040 Filing Instructions, pp. 9-12.

To see instructions for the 2022 IRS Form 1040, click here.

*To determine whether you’ll be a dependent or independent student on the FAFSA, see the Dependency Questionnaire at UCanGo2.org. To learn more about federal and state financial aid, and the FAFSA process, visit StartWithFAFSA.org.